How I Found Toy Investing

The rabbit hole that changed my entire business, and ultimately, my entire life...

Discovering toy investing was a series of happy accidents that started a few months into my Amazon journey. When I first started tinkering with the idea of buying toys for long-term holds, I was still primarily selling oatmeal and bras out of my two-bedroom second-floor apartment. My days consisted of getting to Marshall’s at 8am for opening and then driving all around my city looking for anything profitable I could get my hands on. My afternoons were filled with lugging up dozens of bags full of Trader Joe’s bagel seasoning, and my nights were spent scraping TJ Maxx stickers off of clearance Nike Yoga pants. It was tedious, but wow! was it profitable.

Around this time in early 2020 is when COVID took the world by storm. Due to the pandemic, Disney Land and Disney World were forced to shut their doors. A side effect of this closure was that the parks had no one to sell their inventory to. To remedy this, they began shipping out their exclusive park inventory across the country to all the retail Disney stores that remained open.

To make room for incoming inventory, Disney didn’t care if they made money on these products, they just needed SPACE. As COVID raged on Disney started marking down prices more and more, and eventually started permanently closing down the retail stores. Markdowns got ridiculous, prices we’ll probably never see again from Disney. I’m talking $3-5 for brand new, highly relevant plush toys and action figures of characters that were selling for $25-$30 on Amazon. The best part was that they weren’t one-offs. I was able to buy them by the dozen.

The number of items I was buying quickly outpaced my ability to prep them. In an effort to save time and make space in my tiny apartment, I started just shoving handfuls of product into boxes, taping them up, and tossing them in my closet to prep later.

Fast forward six months.

Amazon was going GREAT. I was now more than able to afford the jump from tiny apartment to a three-bedroom two-bath house with a garage. During the move, I started opening the boxes of product I had stuffed into my closet.

“Oh wow, I forgot about these.”

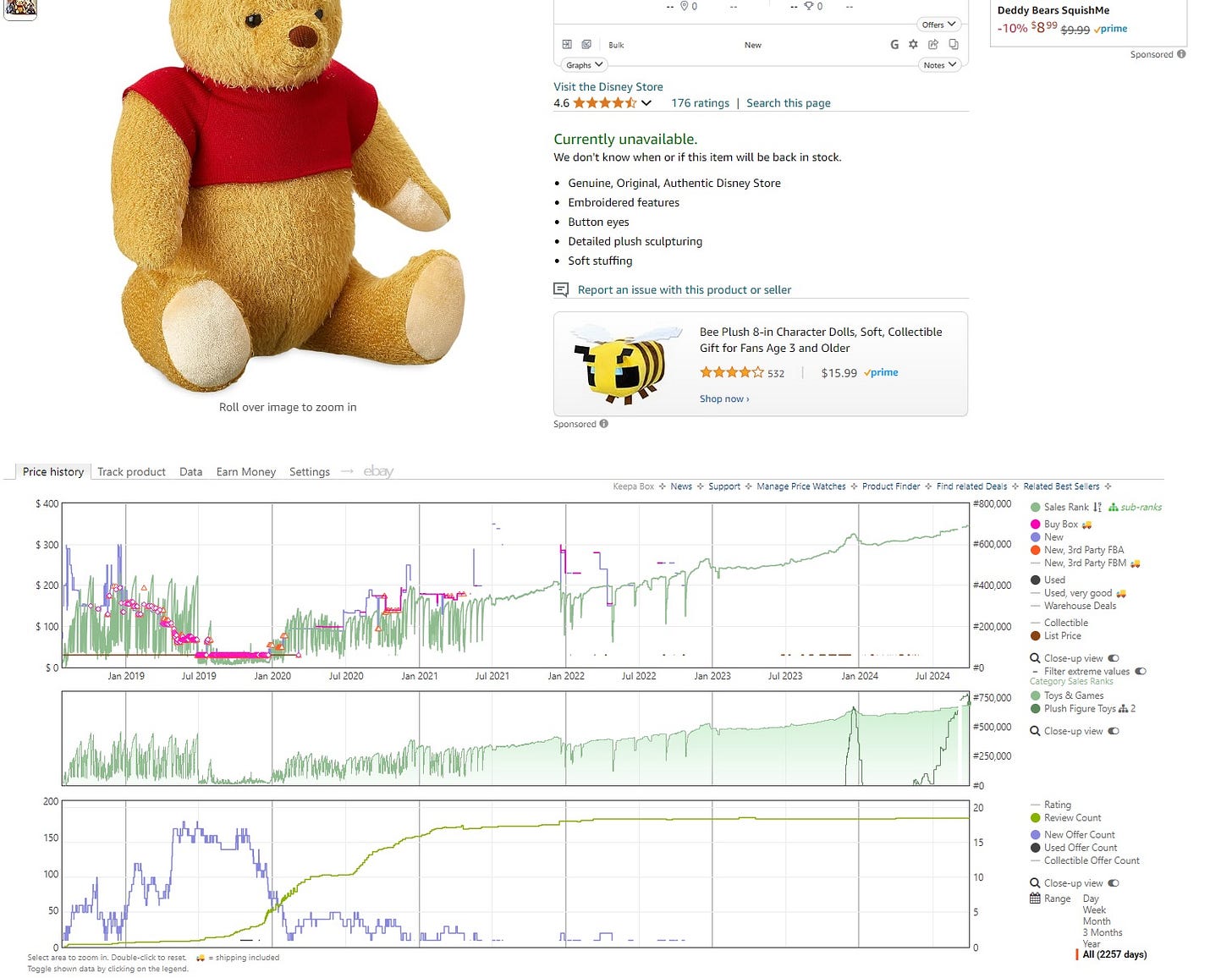

I clearly remember saying these words out loud as I pulled out a plush Fozzie Bear, a Rapunzel frying pan, and a limited edition Christopher Reeve’s Winnie the Pooh plush.

“I wonder what these are going for nowadays…”

Fozzie Bear Muppets Plush (Buy cost: ~$5.00): $60.00

Rapunzel Frying Pan (Buy cost: ~$4.00): $70.00

Winnie the Pooh Plush (Buy cost: ~$15.00): $140.00

Let me tell you, at that moment I understood what the term ‘Disney Magic’ meant.

Unfortunately, It takes me awhile to catch on and my brain didn’t immediately jump to “Duh, discontinued toys rise in price.”

Instead, my first logical conclusion was “Wow, discontinued Disney products rise in price!”

I wasn’t wrong, but I wasn’t seeing the bigger picture.

Naturally, I went back and started looking at my old Disney inventory I still had saved in Seller Central that I had sold out of six months prior.

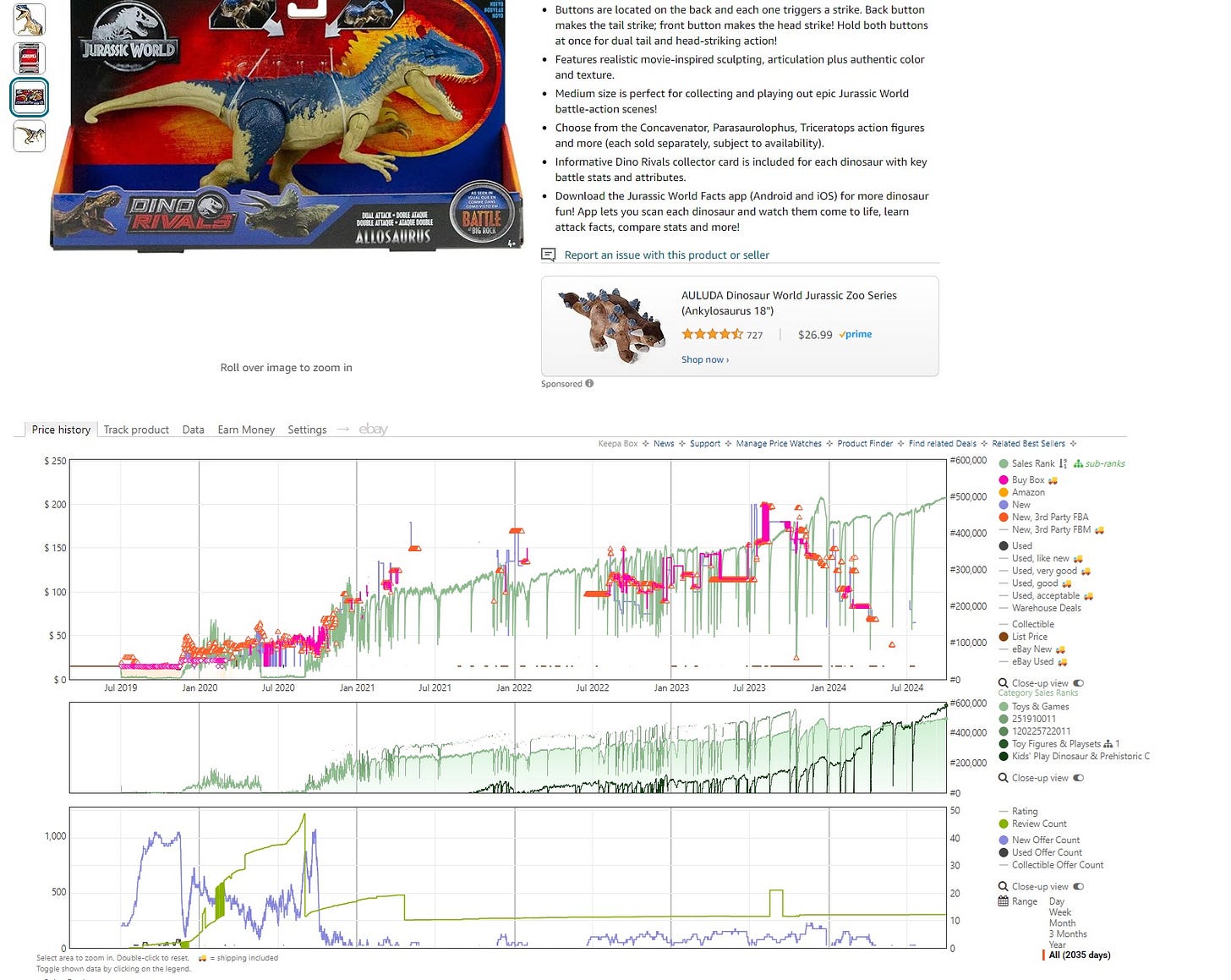

Everything. And I mean everything Disney had increased exponentially. While digging through these old listings, I was also coming across a lot of old toys I had sold from various discount stores. I specifically remember a Jurassic World Allosaurus toy and a Bubble Guppies Bath Squirter set, among many others. Sure enough, they had also skyrocketed in price!

The gears started turning. Discontinued toy + strong intellectual property + patience = profit.

This discovery came at a time when I was running into a frequent problem on Amazon… a problem that I know MANY sellers still face today.

Almost everything I sourced would tank in price as soon as I sent it in.

Other than the Disney Stores closing and some unicorns from Rite Aid, I just couldn’t seem to find deals that others weren’t finding. I found myself sourcing products expecting a 40-50% ROI, only to have it finally check in and barely be profitable. If I waited a month I could probably get 20% ROI, but if I wanted to reach the profit I had originally sourced it for, I’d realistically have to wait a few months at least to achieve it.

So then it occurred to me. Why am I wasting my time with the headache of tanking prices? The evidence is clear. If I can pick the right products and practice a little patience, I can make a lot more money in the same amount of time.

This started my journey to find someone, anyone, who was doing the same thing. I just wanted to know if I was crazy, or if there was actually something there. I started searching YouTube, joining every toy-related Facebook group I could find, and scheduling coaching calls with Amazon gurus to see if they knew where to direct me.

This is where I started to catch wind of things like LEGO Investing and Greg Webb’s book ‘Toyfolio’.

It was at this point I realized that I wasn’t crazy and that I was really onto something. Something that would alter my business for many years to come.

I’m going to reserve what came next (spoiler alert: a TON of failures before finding success) for my paid subscribers of the Toys to Retirement newsletter, but I hope you enjoyed seeing how I got started on this crazy toy journey.

If you want to learn more about this niche, I encourage you to become a paid subscriber and absorb all of the content I’ll be putting out. I’ll be covering hot topics such as product analysis, LEGO investing, toy market trends, and more.

If you’re still unsure about this niche and what it really entails, I encourage you to check out my other complimentary articles such as “What is Toy Investing?” and “About Me”.

What an awesome story! It sounds like those Disney Store clearance days really were "magical"!

I look forward to reading the rest of your content! Thanks for providing this learning opportunity to us sellers that are looking to expand our knowledge!