Hey friends,

Hope everyone is off to a hot start in 2025. I’m feeling very confident about where this year is headed for us toy investors after doing some reflection on my business and looking at where a lot of recently discontinued toys are already trending.

If you’re curious to see my 2024 Year in Review article, I’ll post the link below. I touch on some wins, some losses, and provide some interesting data points that may be worth investigating in your own business. Give it a read when you have time.

Toys are trending nicely!

As I mentioned above, I’m already starting to see some amazing Keepa graphs on toys that I called out in the last few months, several of which have only been technically discontinued for mere days. Here are some examples:

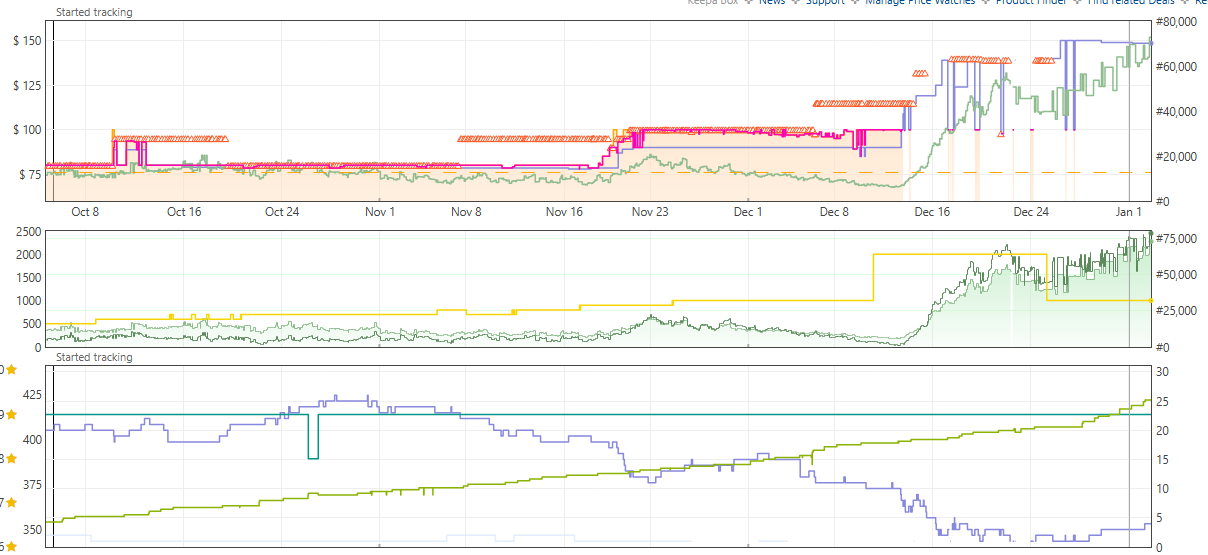

LEGO Technic Bugatti Bolide Agile Blue

Buy cost was $49.99 but I kept purchasing when there was double VIP or gift with purchases. The set currently has 0 FBA sellers and is already giving us $20 profit. With how low the seller count is, I could see this being one of the biggest sleepers of the year that spikes into the $100’s, even before next Q4.

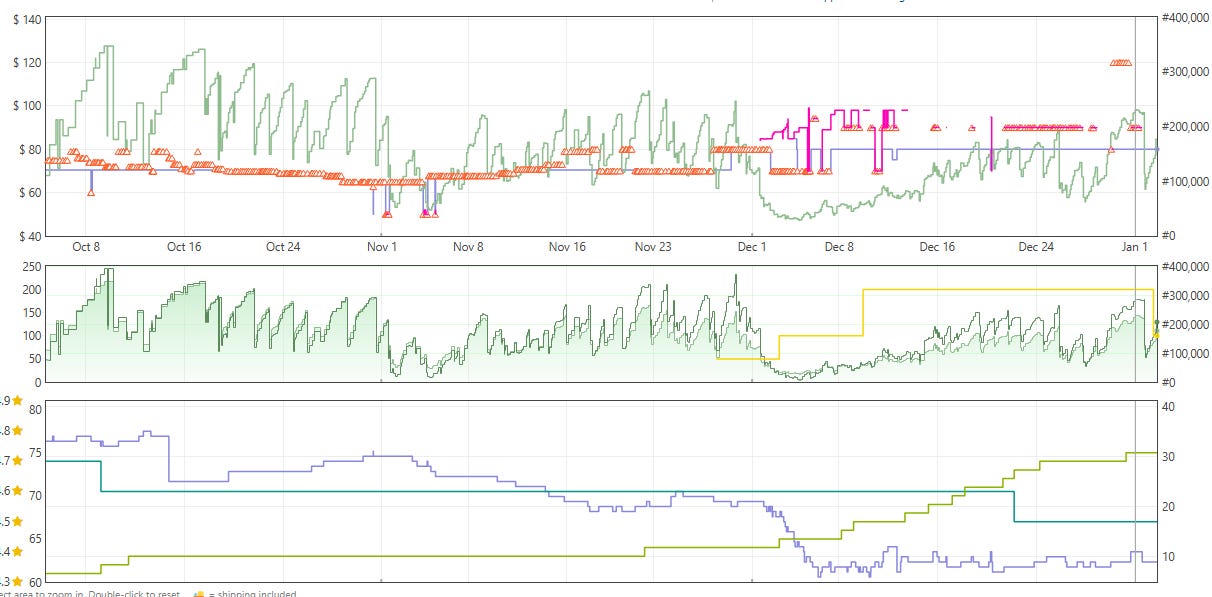

LEGO Technic Firefighter Aircraft

I called this one out as a sleeper that I felt most people would avoid because there’s nothing really special about it, and after doing my Technic analysis I concluded that these were the type of sets in this theme that jumped in price quickly. I said I was considering this at $80, so I began watching it everyday. Sure enough, the price dropped to $56 on Walmart and I snagged a handful before it was gone. Even at $80 it’s currently a winner, as it has 1 FBA seller and is selling for $150+, so you can imagine how happy I am to have got this at the price I did.

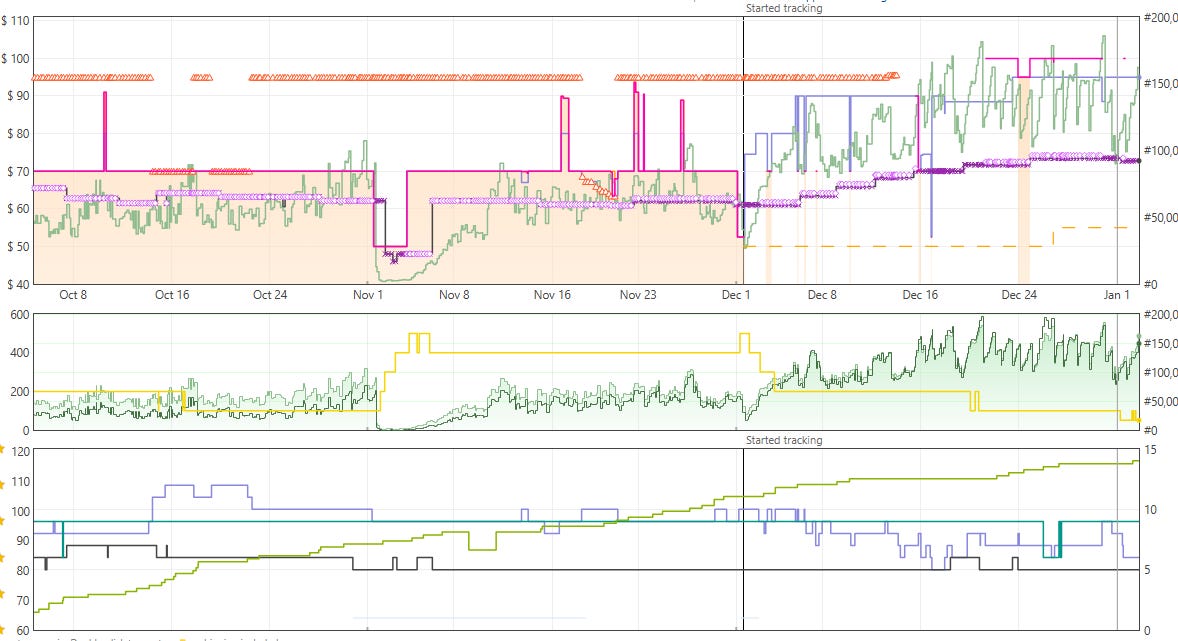

McFarlane Batman vs. Bane 2-Pack

Really excited to see where this one goes. I tossed this one out in my ‘test the waters toy investment lead list’ a few weeks ago when it was on sale for $52.49 and it now has 0 FBA sellers, selling at $99. I wasn’t the biggest fan of pre-ordering it earlier in the year because McFarlane’s production can be unpredictable, but considering it has been around for a bit, Amazon was out of stock, and the buy cost was around wholesale pricing, I couldn’t say no. As long as no major reprint or big player comes in with a huge stock count, I see this easily being $120+. For those that got some, they fit perfectly snug in 15x17.5 bubble pouches by the way. For collectible items that are at this price point and that could possibly be displayed in the packaging, I like to take extra precautions with packaging.

2025 — a big year for Pokemon?

It’s no secret that I like to have Pokemon cards in my toy portfolio. I think of them as product with ‘uncapped potential’, and my intention with them is always long term holds (several, several years). While I don’t think we’re headed into another COVID-esque bull run quite yet, there is no denying that several Pokemon sets are currently spiking in price. Fusion Strike, Crown Zenith, Lost Origin, 151, and Obsidian Flames are all starting to disappear permanently but are maintaining very strong demand. I also think Silver Tempest is a hidden gem of a set that people are sleeping on compared to the attention I’m seeing other sets get.

Besides that though, I think massive opportunity lies ahead with the upcoming Prismatic Evolutions set as well as the future Team Rocket themed set slated for release later this year. If you happen upon a fresh restock in store, you may want to consider some of the sets I listed above for your long term hold closet — take a look at the price of Evolving Skies (B097QLQX53) and Chilling Reign (B091DG4CN9) booster boxes if you want some inspiration.

Another Subscriber Q&A

Since the year ended, we have a lot of new faces who have subscribed to Toys to Retirement. In the coming weeks, I’d like to do another Subscriber Q&A since there was a lot of positive reception to my previous one. For those who have questions, please direct message them to me on Substack, Instagram, or Twitter (@thetoyinvestor). Please keep in mind that the email you receive the newsletter from cannot see your responses, so only reach out to me at the above channels.

This newsletter is all about answering the questions you guys have about toy investing, and I want to make sure I’m providing my insights on things relevant to your interests. If you missed the first Q&A, here it is:

Toys R Gold by Steve French

If you are a subscriber to this newsletter, there is a very high chance you are aware of Steve French (@TheVillage_AMZ on Twitter). He is a buddy of mine who I met virtually through another Amazon Facebook group about four years ago. We’ve been making money on Amazon and Walmart together ever since, and he is one of the few people in the Amazon space that I trust to deliver high quality content to his followers. He is authentic, transparent, and actually in the field doing the work.

This week he launched a paid, toy-focused group called Toys R Gold, with emphasis on buying and holding toys. The group has daily OA leads, a community chat, live Zoom calls every month, and more. Also, all members of his group get paid access to the Toys to Retirement newsletter.

I believe he received around 70 sign-ups on the first day, with the group capping out at 100 members.

I don’t receive any commission nor do I have any incentive to push people to fill his last 30 or so spots. I just genuinely believe in his product and obviously him and I have a lot of overlap in what we do. It was only natural for me to share this with you guys in case you’re looking for additional tools to have in your arsenal.

If you’re interested, you can check out this Tweet for more information: https://x.com/TheVillage_AMZ/status/1874847188125102588

Tip of the Week #9

Discounted Gift Cards — a generic topic you’ve probably heard over and over. But I’m bringing it up today because CardCookie currently has a New Year sale with Target gift cards for 10% off and Walmart gift cards for 7% off. The denominations are usually small, but sometimes a bigger one pops up. For example I just snagged a $100 Walmart one at 7% off and I’ll keep refreshing throughout the weekend to see if I can get more in bigger denominations.

If you read through my year in review article, you’d see that last year I spent around $15k on discounted gift cards. That was nowhere near enough. I aim to at least double that this year, maybe even triple it if the deals pop up.

Buying discounted gift cards shouldn’t take priority over buying inventory if cash is tight, especially if you don’t know what you’ll be buying with the gift card anytime soon. But with Target and Walmart clearance already starting and I know that I buy from them all the time, there’s no reason not to try and snag as many 10% off gift cards as I can. Same with Walmart.

Other sites I use are Cardcash and Giftcards.com.

Go save some money, all of these little percentages add up at the end of the year.

Ok friends, going to call it there. I hope everyone has a great weekend and I’ll be back next week with a very profitable homework assignment for everyone.

Let’s dominate 2025!

I am the biggest Technic bull but I stupidly ignored the Firefighter Aircraft (because my system didn't like it) and feel like an idiot now.

I often make exceptions and this was an obvious one now that I realize you flagged it.

Nice work!