What is Toy Investing?

[This is a long but essential read. I recommend grabbing your morning coffee or heading to the toilet before diving in.]

In the Amazon space, investing can mean different things to different people.

Some people don’t consider a toy an investment unless they place it in a storage unit for some arbitrary amount of time. Some believe that a toy cannot be considered an investment until it is discontinued and no longer available in retail stores. Some people even outright refuse to admit that toys can be considered investments and instead prefer to always refer to them as “flips”.

I define toy investing as purchasing a toy with the expectation that its future resale value will exceed its current resale value.

This differs from a traditional “flip”, because a flip is a situation in which you are looking at current data, and are happy to sell that product now for its current market price.

Why does this matter? Because in toy investing, this difference in sourcing philosophy is our opportunity. Let me explain with two examples.

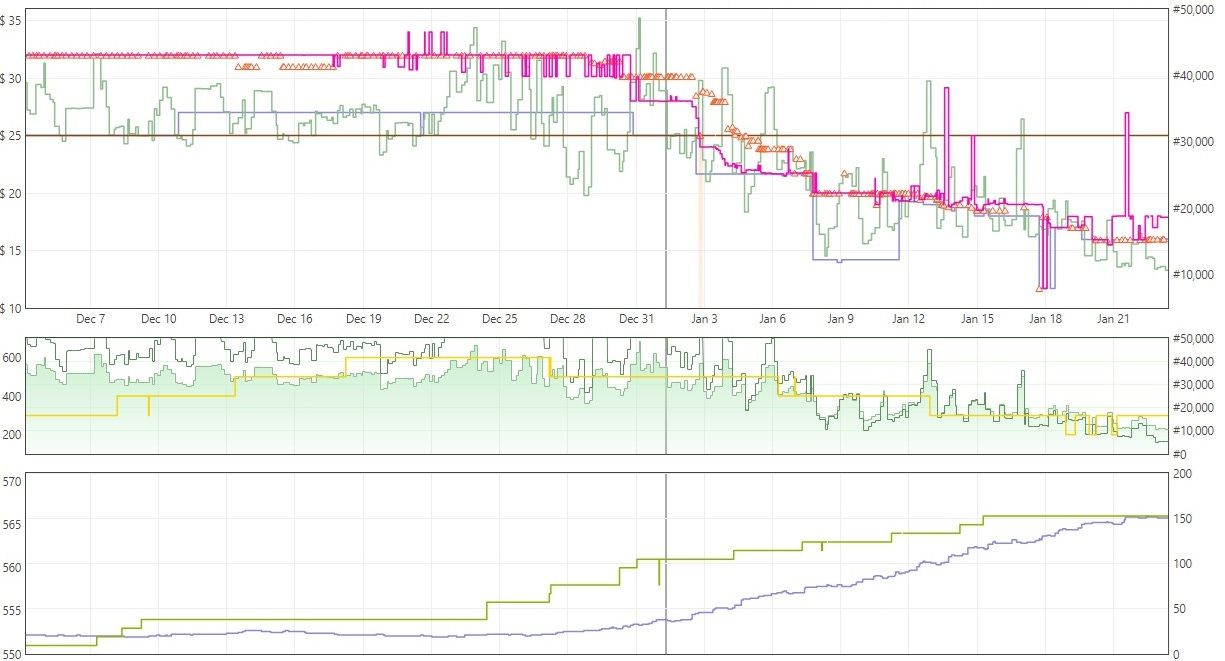

You are digging through the clearance section at your local Walmart. You come across an entire shelf full of a $10.00 Transformers toy. Upon scanning the barcode, you find it listed at $29.99 with less than twenty sellers. Home run! You take them home, prep them, and ship them off to Amazon. A few weeks later the toys are checked in, and you excitedly check the price.

TRIGGER WARNING: Every reseller’s worst nightmare

Hold on. $16?! 150 sellers?! What happened?

The same, predictable thing that happens way too often when sourcing… everyone else at Walmarts across the nation reacted to the same data and eagerly hopped on the same train as you. At this point, you must decide whether to sell now and break even, or wait for an unknown amount of time for the price to recover.

Let’s compare that to a different scenario.

You are at the same Walmart, digging through the same clearance section and you find a Five Nights at Freddy’s action figure marked down to $8.00. You check the price on Amazon and… you’re not impressed. It’s listed at $15.99, barely profitable and definitely not worth your time. But you notice that Amazon isn’t in stock and there aren’t that many sellers on it - similar to the Transformers toy.

Wait a second. Isn’t there a new Five Nights at Freddy’s movie coming out in two months? When the movie comes out, could it increase demand, decrease supply, and in turn increase the price?

You decide to take the gamble. You load up your cart, take them home with you, and toss them in your closet for a couple of months.

Two months breeze by and it’s opening weekend for the movie. Demand skyrockets practically overnight, and out of the millions of people who saw the movie opening weekend, several thousand of them want Five Nights at Freddy’s toys. Naturally they flock to Amazon, and of the several thousand looking for FNAF toys, hundreds are looking specifically for the one that you found at Walmart.

You check the listing and you’re shocked to see it now only has two sellers and is selling for $29.99! Not only did the sellers start to dwindle over the last two months - they also dropped like flies as soon as the movie was released. On top of that, the number of sellers never spiked like they did for the Transformers toy because the FNAF toy wasn't profitable at the time.

But it’s profitable now.

Notice the difference in performance for these two products?

Would you rather be the poor soul stuck with the break-even Transformers toy, waiting for 150 other sellers to sell out over an unknown period of time? — or would you rather be the genius grand master chess player who took an educated gamble on a toy investment that ended up being wildly profitable?

I’ll take number two every time, and that’s why most of my business today revolves around toy investing. That difference in sourcing strategy, mixed with a little bit of patience, can take you from toys to retirement.

Now don’t get me wrong: a flip-focused business model can still be a profitable venture, and toy investing comes with its own challenges.

But by molding your business into a combination of the two, you will discover new opportunities you may have previously overlooked.

Let’s look at some pros of toy investing:

1) Usually higher ROI than quick flips

It is not uncommon for a toy to hit 100%+ ROI a year after buying it (sometimes sooner!). In the flipping world, 100% ROI flips are unicorns. Most people are happy to consistently find 30-40% ROI flips. In toy investing, we set our sights higher.

2) Less competition on listings when the time comes to sell

When hunting for flips, your competitors are often finding the same deals and items as you are finding. This usually leads to crowded listings and tanked prices, which may take years to recover. In toy investing, when it comes time to sell, I commonly find myself competing with just a handful of other sellers. These competitors are usually playing the same game as I’m playing, so they understand the value of pricing with confidence, not pricing with fear.

3) Minimal threat of Amazon being on the listing

Isn’t it nice when Amazon sells out and just… never comes back? When toy investors choose a product, most of those purchases happen at the end of a product’s life cycle. Not only is the product fading from physical storefronts, but Amazon should be running out of supply as well. When analyzing my own Q4 inventory, I’m confident that come December, Amazon will not be on a single one of the listings. This will allow me to command higher sale prices for my investments. When I was primarily focused on flips, I was constantly anxious about when the “right” time to sell was, for fear of Amazon restocking and completely dominating the buy box. That isn’t an issue for me now that I strategically invest in toys that have been discontinued.

4) Can usually acquire bulk amounts of inventory

This isn’t impossible to do when hunting for flips, but it is much easier when you are planning for the future performance of an item rather than reacting to the same data as everyone else. If everyone is buying the same item, then there’s less for you to buy.

When I did mostly flips, I was pretty pumped to get 100 of a SKU after a hard day’s work. Nowadays, I can have hundreds or thousands delivered to my doorstep with a single phone call to one of my suppliers. Why? Because I’m being proactive and betting on how the product will perform in the future, not how it’s performing right now.

In other words, the potential profit isn’t immediately obvious, so my competitors aren’t flocking to the same items that I am.

5) Less ‘work’ than constantly chasing quick flips

I’m not going to pretend that making 100% ROI on a toy once per year is financially optimal vs. flipping that same money for 20% every month for a year… because it’s not. 20% every month wins every time. But, it sure as heck is a lot less work to order something in January, put it in storage until October, and then ship it to Amazon in November. If chasing the latest flip and hunting for your next dollar has you burned out, then you may find some relief with toy investing.

Now let’s look at some of the cons:

1) Capital will be tied up for extended periods of time

The more toys you buy for the long haul, the less cash you have for quick flips: a tragic and unfortunate reality of our business. However, the good news is that if you are making the right investments, the value of your money will grow faster when invested into an action figure than a typical 401k.

2) Not optimal for growing bankroll. 20% ROI flips every month bring more money than a 100% ROI flip once a year

This was stated above but needs to be said again. If growing your bankroll in the most optimal way possible is your goal, then toy investing is not the way. Flipping will generate you more money, but at the cost of taking more work.

3) Will require some sort of long term storage solution

This con is strong deterrent for some people. A storage unit or even just a spare bedroom is perfect, but not everyone is willing or able to take that step. There are other storage solutions, such as eating the VERY expensive storage fees from Amazon and keeping your items in stock there, but I don’t recommend it. If you want to do it the right way, you’re going to need to find space. Eventually, profit per square foot of space will become another challenge. You don’t really use that closet in your spare room anyway, right?

4) Some toys are more of a gamble than others, nothing is guaranteed

To be fair, this con could be applied to anything in the ecommerce world. But there definitely are risks that come with toy investing that aren’t as prevalent in other business models. Intellectual properties (d)evolve; movies bomb; actors get bad PR; and sometimes manufacturers can completely decimate the market by over-producing a toy. That doesn’t really happen with oatmeal or lotion. Our job as toy investors is to have a balanced portfolio of toys, both high-risk and low-risk, just like a stock market portfolio.

5) Some toys get discontinued in favor of new versions, making the old one obsolete

This piggybacks off the previous con, and is just another reminder that, ultimately, manufacturers are in control. A toy can check all the boxes and seem like a grand slam - just for the manufacturer to strike you out. All part of the game.

With all of these things in mind, who is toy investing best suited for?

While the pros and cons listed above are not exhaustive, it’s a good start for determining if this endeavor is for you. I’m not going to upsell this business model to you and pretend it’s all sunshine and rainbows - I believe in transparency and honesty. Let me break down who I think toy investing is good AND bad for.

Toy Investing is NOT for you if:

You’re brand new to Amazon and have not explored other entry-level business models like retail arbitrage and/or online arbitrage

Your goal is to grow your bankroll as quickly as possible

You are not patient

You have no interest whatsoever in pop culture, current trends, or toys in general

You are extremely risk-averse (toy investing is primarily speculation and educated guessing)

Toy Investing IS for you if:

You have established the ‘meat and potatoes’ of your Amazon business and are looking for some ‘gravy’ to add on top

You have more capital and are unsure where to allocate it

You are looking to do less work for respectable profit

You enjoy your 9-5 and are just looking for some extra money every year to get you closer to retirement with less time needed than a traditional Amazon business

You are passionate about pop culture, current trends, toys, and are excited about the intellectual properties that are prevalent today

You find yourself constantly sourcing products that tank and you find yourself waiting 6+ months for them to recover.

Cool. I think we’ve established a good baseline of what toy investing is and why it may or may not be for you. It took me a couple of years to really nail down the concepts of toy investing to get to the level I am at today. A big part of my process was figuring it out as I went along and learning from mistakes that cost me literally tens of thousands of dollars (don’t worry, I’ll share these mistakes with you throughout my newsletter!).

Even if you aren’t quite ready to take the full leap into the business model, I encourage you start familiarizing yourself with the business model, either through my paid newsletter or elsewhere. Many of the thought processes and strategies I outline in my Toys to Retirement newsletter are applicable to other categories, including flipping. Just make sure you’re learning from someone who is active in the Amazon space.

If you’re still on the fence about becoming a toy investor, I encourage you to check out my How I Found Toy Investing article. It is complimentary for all subscribers, paid or not, and you may relate to some of the struggles I faced when I strictly did flips.

Don’t forget to also check out my About section for more info on some specifics of my business. Lastly, if you feel like you’re just about ready to become a paid subscriber, check out the Before You Subscribe… section to make sure you’re ready for what’s ahead.